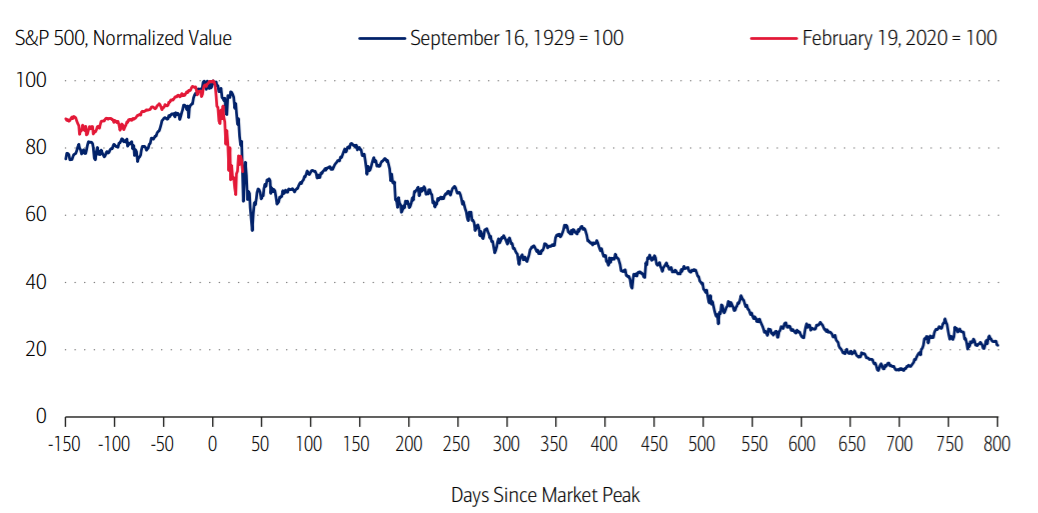

Periods of extreme economic and financial stress are often compared against the ‘Great Depression’ to gauge severity. However, we believe the current ‘Coronavirus’ crisis will not have as severe an impact on the market due to several factors. These factors include, better and more coordinated policy response globally, a more resilient banking sector and a more flexible monetary system.

Much can be learned from history about how to respond to periods of extreme economic and financial stress. However, we believe that there are key differences between now and the 1930s, in the area of government policy response and the financial backdrop:

The Gold Standard was in place during the 1930s, thus constraining the growth of money supply and central banks’ ability to embark on any quantitative easing like type of programmes.

Today though, the world is based on fiat currencies. Thus, central banks can increase their balance sheet size to reignite growth.

In the 1920s, the Federal Reserve was in a rate hiking cycle, raising its interest rates and keeping it high.

In contrast, today the Federal Reserve has cut rates to zero and has restarted its quantitative easing programmes.

There were bank runs and many banks collapsed in the 1930s.

Today, the banking system is more well-capitalised, partly due to the additional capital requirements put in place after the 2008 Global Financial Crisis.

In the 1930s, many countries embarked on protectionist trade policies. In the US, the Smoot-Hawley Tariff Act raised tariff by an average 20%.

Today on the other hand, apart from President Donald Trump in the US who espouses implementing tariffs to protect home industries, there are fewer political leaders who endorse this trade policy.

In the US, the government raised taxes on households and companies to balance the budget. Thus, creating additional drag on the economy.

In comparison, many countries are implementing fiscal stimulus:

The reflation of the large economies would have trickle down effect globally.

While markets may dip over short periods, the long-term trend is up. Hence, focus on the long-term trend.

You can invest for the long term by setting up a bespoke investment plan through Crea8’s Goal based investing service.

In times of crisis, central banks cut interest rates. Take advantage of this by investing in assets and companies that stand to benefit from lower interest rates through Crea8’s ‘Interest Rate Cut’ strategy. These includes bond ETFs and companies with high dividend yields, amongst others.

Take advantage of Crea8’s Analytics function to filter out undervalued companies that have been oversold and stand to beat the market in the medium-long term. Alternatively, use Crea8’s Advisory function to apply a ‘value’ tilt to one of our pre-built strategies.