Want to retire comfortably without worrying about your finances? Read on for some insight on how this could be possible with Crea8.

The UK’s Pensions and Lifetime Savings Association suggested GBP 33,000 annually for retirees in 2019.

Malaysia’s Employees Provident Fund (EPF) on the other hand, sets MYR 228,000 as the minimum amount of retirement savings that people should have at age 55.

So, rules of thumb number may not be suitable for everyone. Depending on your lifestyle, you may need more or less.

A comfortable retirement depends on many factors: your age, your ideal monthly pension, your current savings, your gender, etc.

Crea8 offers a bespoke investment planning service to put you on track to realise your dream retirement without compromising your current lifestyle.

Having a bespoke plan from Crea8 is important, but it is equally important to start working on the plan early. The habit of saving a certain portion of your salary for your retirement should be inculcated from the start of your working life and practiced throughout your career.

Some people can find it hard to save due to various commitments, for example mortgage, car loan, student loans and utility bills.

In order to help you save and invest for retirement, we have put together some tips on how you can free up cash.

A lot of people splurge on nice cars and fancy apartments once they start earning a decent monthly income. This naturally would increase your monthly commitments, leaving less for retirement savings.

Consider holding off buying that expensive car or house and saving that additional money instead. But if you do need to spend, then let Crea8 help you plan for it.

Assess your monthly budget and cut unnecessary expenses. They could be that extra cup of coffee or that gym membership that you never use.

This may seem like minor at first, but when you add it up throughout the years, it can amount to a significant part of your retirement savings.

Instead of having a premium coffee every day, take a regular coffee and save that SGD 5 or AUD 5. If you invest this every day between 25 and 60 years old and earn 8% annually, you would have got about SGD 240,000 or AUD 240,000 more by the time you are 60 years old.

Consider picking up a second job or adding a side-business. For example, you could tutor the kids in your neighbourhood on the weekends.

Some jobs could help you save on top of adding another income stream. For example, if you get a weekend job at the gym, you could get a free membership while earning money at the same time.

Saving is not enough. You need to invest to ensure that your wealth grows over time. And, the earlier you start saving and investing, the better off you will be.

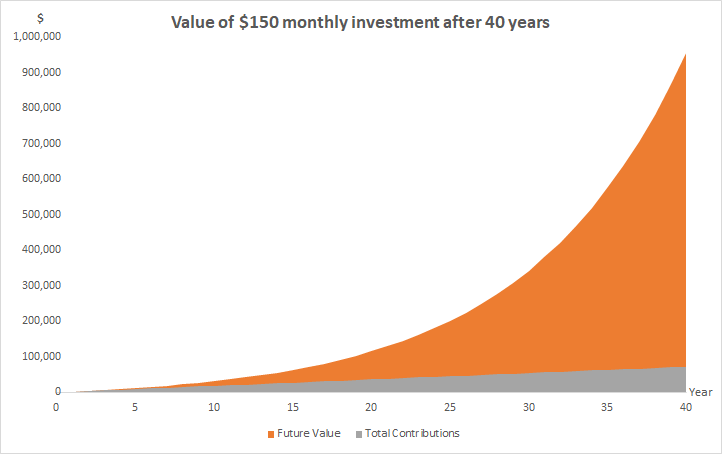

A small amount invested could grow big over the long run thanks to compound interest.

For example, if you start investing at 25 and put $150 monthly into an investment that returns 10% per annum over 40 years, by the age of 65 you would have accumulated $956,667.

Saving and investing are necessary steps to work towards that retirement pot. However, having a personalised plan is more important since we have different needs and aspirations.

There is continuous trade off between spending now or saving it for later. We recognise this tussle. Hence, we allow you to plan for extra savings or expenses with our detailed future savings plan. This way, you can know the impact of your decision.

Any detailed retirement plan is at risk of your good blessing of having a long live. Such longevity risk is widely known and we integrate it as part of your legacy planning.

Whether it is market movements or changes in your lifestyle, your plan will adapt and Crea8 will advise you accordingly.

We recognise that there will be times that you need additional cash, so you could even withdraw against your retirement plan as long as you know how much more you need to save to catch up.

We ask you a series of questions to determine your personal circumstances and risk characteristics. Then we adopt the Markowitz approach – from the Nobel prize-winning economist – to create a personalised diversified investment plan which is accessible 24/7.

Your plan is rebalanced regularly automatically, or we will send you a reminder to do so. This way, you can sit back and relax knowing that your investments are on target to meet your retirement goal.

Crea8 monitors your portfolio automatically by placing cut loss and take profits orders so that your retirement goals are not affected by extreme market movements.

Everybody wants to enjoy a comfortable retirement. However, getting there requires some disciplined saving and investment over time.

Crea8 helps you with this and can also give you advice on how to invest throughout the other stages of your life

The potential to outlive your retirement pot can be stressful to consider. Find out how we can help mitigate this issue for you here.

For further insight into our investment methodology including our Goal based investing methodology and Factor based investing methodology, check out our white papers.