Electric vehicles have actually been around since the late 1800s. The first successful electric car made its debut around 1832 thanks to a Scottish inventor called Robert Anderson. Anderson’s pioneering work involved strapping a non-rechargeable battery and a motor onto a carriage to create the first ever horseless carriage. Over the next few years, there was a flurry of electric vehicles produced but this was curtailed by the discovery and extraction of huge reserves of petroleum across the globe.

Roll forward to the 1990s, car manufacturers renewed their interest in producing electric vehicles. Amongst the first was General Motors (GM) with their EV1 produced and leased from 1996 to 1999. The Toyota Prius, released in Japan in 1997, became the world’s first mass-produced hybrid electric vehicle. In 2008 Tesla launched its Roadster to market in 2008. Other major car brands were quick to follow. By 2010, the Chevy Volt (the first commercially available plug-in hybrid) and the Nissan LEAF (fully electric) were released in the US.

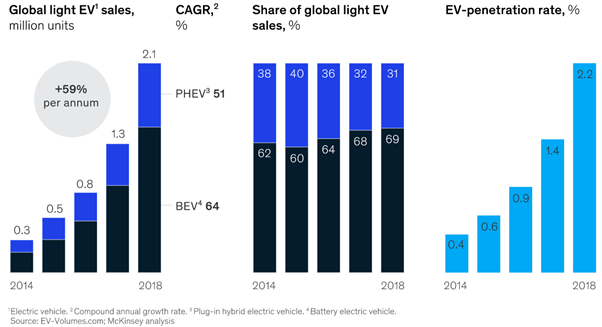

Today, there are around 40 models of Battery Electric Vehicle (BEV) and Plug-in Hybrid Electric Vehicle (PHEV), with the most popular models coming from Tesla, including the Model 3, Model S and Model X.

Within the services offered by FinTech firms, the most commonly used category is money transfer and payments, with 75% of consumers using at least one service in this category. In China, where money transfer and payment apps are pervasive, the adoption rate is 95% (Bull, Chen and Chiselita 2019).

The most used services in money transfer and payments category are peer-to-peer payments, non-bank money transfers, and in-store mobile payments due to the ease of setting up an account. Insurance shows strong adoption as well, with nearly half the consumers globally using a premium comparison site, feeding information into an insurance-linked smart device, or buying products such as peer-to-peer insurance (Bull, Chen and Chiselita 2019).

For most people, driverless cars remain a science fiction concept. However, they already exist today. Autonomous vehicles developed by several different firms have already safely driven millions of miles over the past few years.

Vehicles tested by Google’s Waymo have driven twenty million miles and now clock up 25,000 miles every day. Autonomous shuttles by companies such as Navya are operating in public areas in Switzerland, Germany, France and the US. Furthermore, driverless taxis are being tested on the streets of Pittsburgh by Uber and Volvo, and of Singapore by Nutonomy.

An obvious way would be to invest in the companies that are building these electric vehicles and self- driving vehicles. Leaders in this space include the likes of GM, Mercedes and BMW.

Next would be the companies producing lithium-ion batteries that power electric vehicles such as Panasonic and the makers of the sensors, software, and computing hardware required to make vehicles self-driving such as Nvidia, Qualcomm and Microchip Technology.

Through Crea8’s ‘Global Electric Vehicles and Driving Technology’ theme, you get to invest in companies that are leading the way for this trend, including the likes of Tesla, GM and Nvidia.

The convergence of Electric Vehicle and Driving Technology trends into the “Global Electric Vehicles and Driving Technology” theme gives you access to a long-term investment theme that can outperform the market and is also diversified.

Through Crea8’s Factor Based Thematic Investing Service, you get the opportunity to invest in this trend.

Hertzke, Patrick, and Ting Wu. 2019. “Expanding Electric-Vehicle Adoption Despite Early Growing Pains”. Mckinsey.Com. https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/expanding-electric-vehicle-adoption-despite-early-growing-pains.

“Road Traffic Injuries”. 2020. Who.Int. https://www.who.int/news-room/fact-sheets/detail/road-traffic-injuries.