The world’s population is ageing with virtually every country experiencing growth in the proportion of elderly people in their populations. According to data from the UN, by 2050, one in six people in the world will be over the age 65 (16%), up from one in 11 in 2019 (9%), giving rise to the “Silver Economy”.

In this article, we aim to educate readers on what this trend means for consumption growth globally, and how an investor can take advantage of this trend with Crea8.

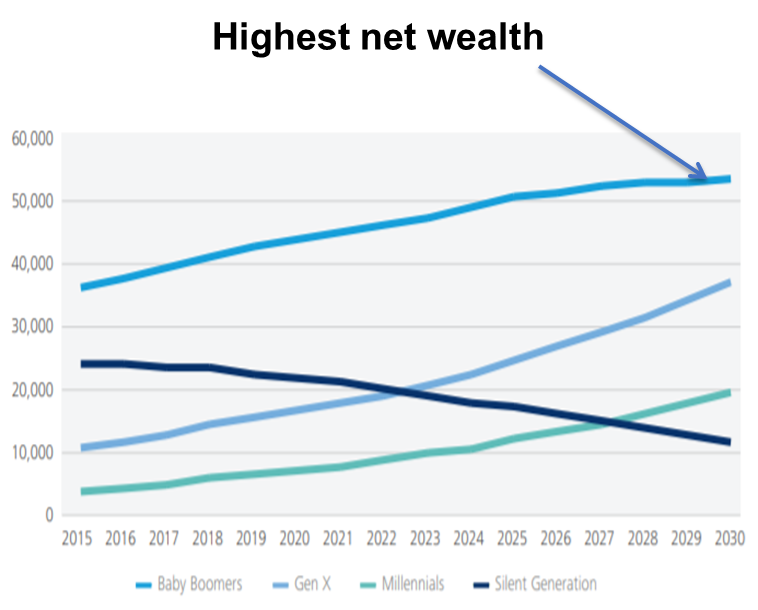

Based on data and projections by Deloitte in the US, Baby Boomers (defined as those between the ages of 51 – 69 in 2015) had the highest net wealth compared to the Silent, Millennial and GenX generations in 2015 (Srinivas and Goradia 2020). The Baby Boomer generation in 2015 had a net wealth of USD38 trillion. This is expected to rise to USD53 trillion in 2030.

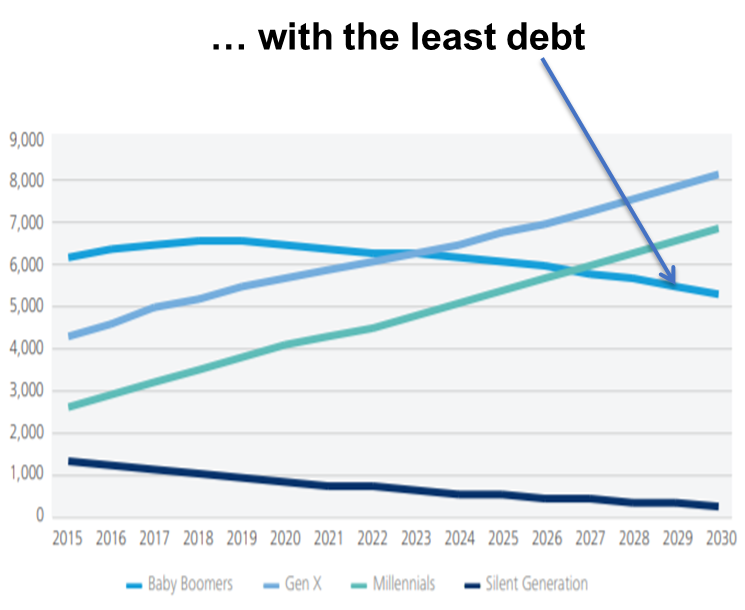

Further, the Baby Boomer generation is also expected to see declines in their level of debt. Baby Boomers’ debt, currently estimated at USD6.1 trillion, is projected to peak within the next few years and then gradually begin to slide, reaching USD5.3 trillion by 2030. By comparison, Gen Xers and Millennials will see debt levels rise significantly more quickly (at a CAGR of 4.3% and 6.5%, respectively) in the next two decades.

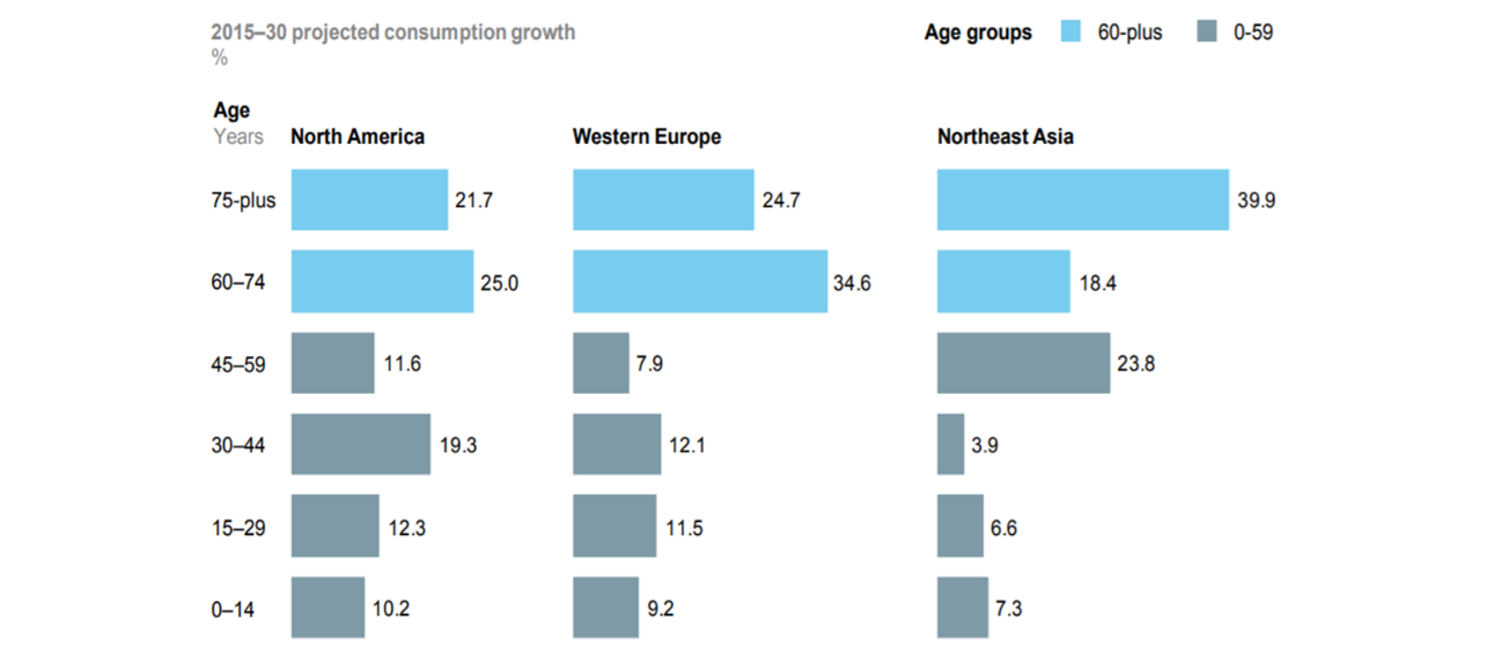

With strong balance sheets behind them, seniors and the elderly will be a significant driver for consumption growth globally. This is especially the case in developed regions such as North America, Western Europe and North Asia.

According to estimates by McKinsey Global Institute (Figure 3), the developed retiring and elderly will generate 51% of urban consumption growth in developed countries, or USD4.4 trillion, in the period to 2030. That is 19% of global consumption growth (Dobbs 2020).

As well as increasing in number, each individual in this group is consuming more, on average, than younger consumers, mostly because of rising public and private health-care expenditure. But it’s not just health-care that they are spending on.

People aged over 50 bought nearly two-thirds of the new cars sold in the United States in 2011, according to one study. Half of all Americans riding Harley-Davidson motorcycles are also baby boomers.

Between 2015 and 2030, the 60-plus age group in the developed world is projected to contribute 40% or more of consumption growth. This extends to categories such as personal care, housing, transportation, entertainment, and food and alcoholic beverages.

These trends thus give rise to the “Silver Economy”. The Silver Economy is the sum of all economic activity serving the needs of elderly/aged, including products and services they purchase and the knock-on economic activity this spending generates.

Silver investment strategies have been around for a while but many have struggled to provide a portfolio of stocks that can maximise returns from this trend.

The issue is that inherently heterogenous firms can benefit from the Silver Economy in different ways. Thus, investing in the Silver Economy requires careful analysis of the goods and services this group will demand before adopting a specific investment strategy

Nevertheless, Crea8 has dedicated time to analyse the market and put together an investment strategy with a portfolio of stocks that will maximise returns from this trend. The ‘Global Ageing Society’ investment strategy lets you ride on this trend by investing in the stocks of companies that will benefit from the ageing population trend.

Through Crea8’s Factor Based Thematic Investing Service, you get the opportunity to invest in this trend.

Looking for all the stocks to invest in this megatrend might turn your hair grey. Instead of that, try out our Factor Based investing service to get an easier way to invest in stocks that stand to benefit from increased adoption of electric vehicles and driverless cars around the world.

Dobbs, Richard. 2020. “Urban World: The Global Consumers To Watch”. Mckinsey Global Institute. https://www.mckinsey.com/featured-insights/urbanization/urban-world-the-global-consumers-to-watch.

Srinivas, Val, and Urval Goradia. 2020. “The Future Of Wealth In The US”. Www2.Deloitte.Com. https://www2.deloitte.com/content/dam/insights/us/articles/us-generational-wealth-trends/DUP_1371_Future-wealth-in-America_MASTER.pdf.