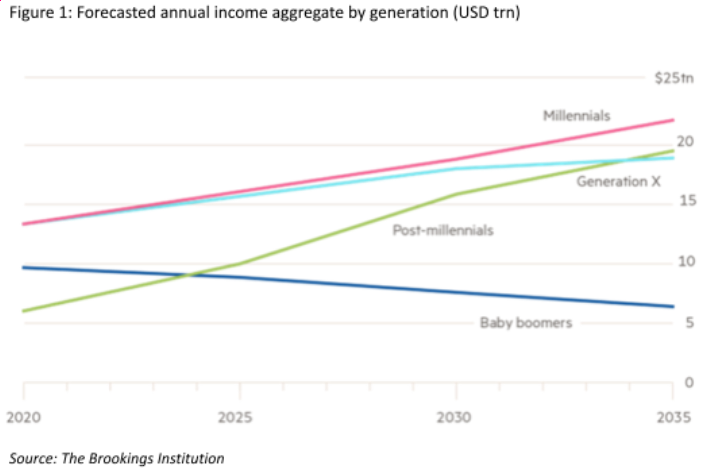

The millennial generation can be defined as those born between 1981 and 1996. In 2016, millennials overtook Generation X as the largest group in the US labour force. In terms of aggregate income and spending power, it is unsurprising that at the global level, millennials will be the reigning economic powerhouse over the medium-term (Hofer and Fenz 2020).

Hence, companies that can win millennials’ business stand to enjoy robust economic growth for years to come. However, winning over the millennial generation would require understanding their preferences.

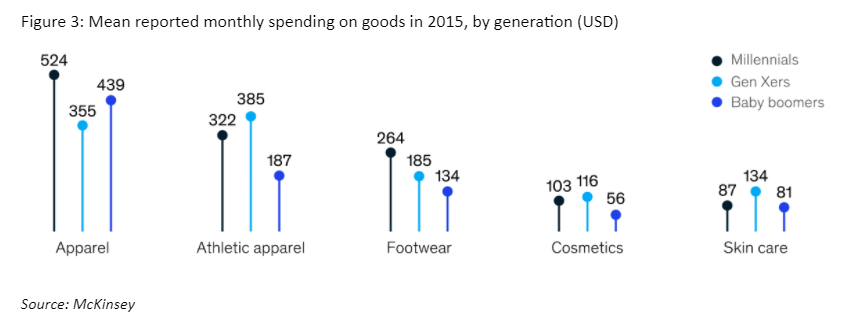

A survey by McKinsey found that millennials are willing to pay premium prices for both goods and experiences. Just over half of millennials that were surveyed indicated that they do not mind paying more for quality products that will last for years (Finneman and Schmidt 2020).

This willingness to pay for quality extends across multiple product categories, such as restaurants, tech devices, apparel and footwear.

In 2015, millennials reported spending USD164 per month on average on entertainment, such as restaurant visits, movies and sporting events, versus USD101 for Gen Xers and USD134 for baby boomers. On apparel, millennials spend $524 per year versus $355 for Gen Xers and $439 for baby boomers. For footwear, those numbers are $264, $185, and $134, respectively.

Whilst millennials are willing to spend on experiences and ‘lifestyle’ consumer goods such as apparel, footwear and tech devices, they are less willing to spending on big ticket items like cars and houses, though, millennials are not spending as much (Figure 4).

For these items, millennials take a more asset-light stance toward consumption, putting off buying a home in favour of renting, forgoing a car loan payment and taking a ride sharing service, or skipping a hotel in favour of booking a room via AirBnB. This asset-light approach fits their budgets as millennials took longer than expected to enter the job market and have student debt to service (Fry 2013).

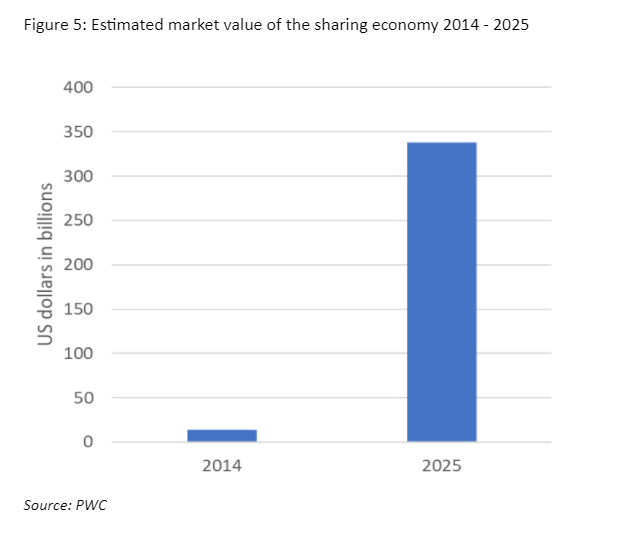

Hence, the millennial generation is also the more likely generation to embrace the sharing economy concept. The sharing economy can be thought of as an economic system that is based on people sharing otherwise idle assets and services, either for free or for payment, using the internet to organize this.

The concept encapsulates two key features:

In essence, technology matches buyers/demand and sellers/supply to reduce market inefficiencies. The sharing economy was born out of a combination of:

The combination of big data and sophisticated platforms that run algorithms enable idle assets and services to be matched with demand. On top of this, the global take-up of smartphones, fast mobile internet, increased trust in online payments and review/rating systems have helped the sharing economy boom.

The sharing economy model has brought about a shift in the idea of owning the means of capital/production. That model dominated economic thinking from the industrial revolution through the 20th century, but is now often viewed as old-fashioned, slow and inflexible.

In contrast, Sharing Economy leaders are asset-light, with Uber not owning any cars, Airbnb not owning any hotels, Amazon having only a handful of brick-and-mortar stores, and eBay not managing a supply chain.

Estimates by BofA estimate current potential sharing economy market to be worth USD 2 trillion globally; but the current actual market addressed is only USD 250 billion. The addressable market in the US is US$785bn, US$645bn (€572bn) in Europe and US$500bn in China (Durden 2017).

Meanwhile, PwC forecasts that the sharing economy market opportunity could grow to US$335bn by 2025E with transport, home sharing, staffing, streaming and staffing expected to be the fastest-growing verticals, with 2013-25E CAGRs of 17-63% (Durden 2017).

With millennials set to become the highest earning generation in the years to come, companies that are catering to their needs and wants are likely to outperform in terms of earnings. Further, the popularity and growth of the sharing economy model will mean companies operating such business models will also see higher than average earnings growth. Hence, portfolios invested in these companies are likely to benefit from long term outperformance vs market.

Crea8 has put together an investment strategy to ensure you don’t miss out on investing in this trend. The ‘Global Millennials and Sharing Economy’ investment strategy lets you ride on this trend by investing in the stocks of platforms, services, and companies that are catering to millennials and in the sharing economy sector.

Through Crea8’s Factor Based Thematic Investing Service, you get the opportunity to invest in this trend.

Hofer, Martin, and Kathrina Fenz. 2020. “How To Harness The Spending Power Of Millennials: Move Beyond The US”. Brookings. https://www.brookings.edu/blog/future-development/2018/04/30/how-to-harness-the-spending-power-of-millennials-move-beyond-the-us/.

Fry, Richard. 2013. “Young Adults After The Recession: Fewer Homes, Fewer Cars, Less Debt”. Pew Research Center’S Social & Demographic Trends Project. https://www.pewsocialtrends.org/2013/02/21/young-adults-after-the-recession-fewer-homes-fewer-cars-less-debt/.

Finneman, Bo, and Jennifer Schmidt. 2020. “Cracking The Code On Millennial Consumers”. Mckinsey.Com. https://www.mckinsey.com/industries/retail/our-insights/cracking-the-code-on-millennial-consumers.

Durden, Tyler. 2017. “A Primer On The “Global Sharing Economy” In 20 Charts”. Zero Hedge. https://www.zerohedge.com/news/2017-07-24/primer-global-sharing-economy-20-charts.