The adoption for FinTech services has grown pervasively these past few years (Bull, Chen and Chiselita 2019), and the risk of cybercrimes has grown with it. This is because FinTech firms operate online and handle sensitive information from their customers, so they are also more susceptible to cyber-crime.

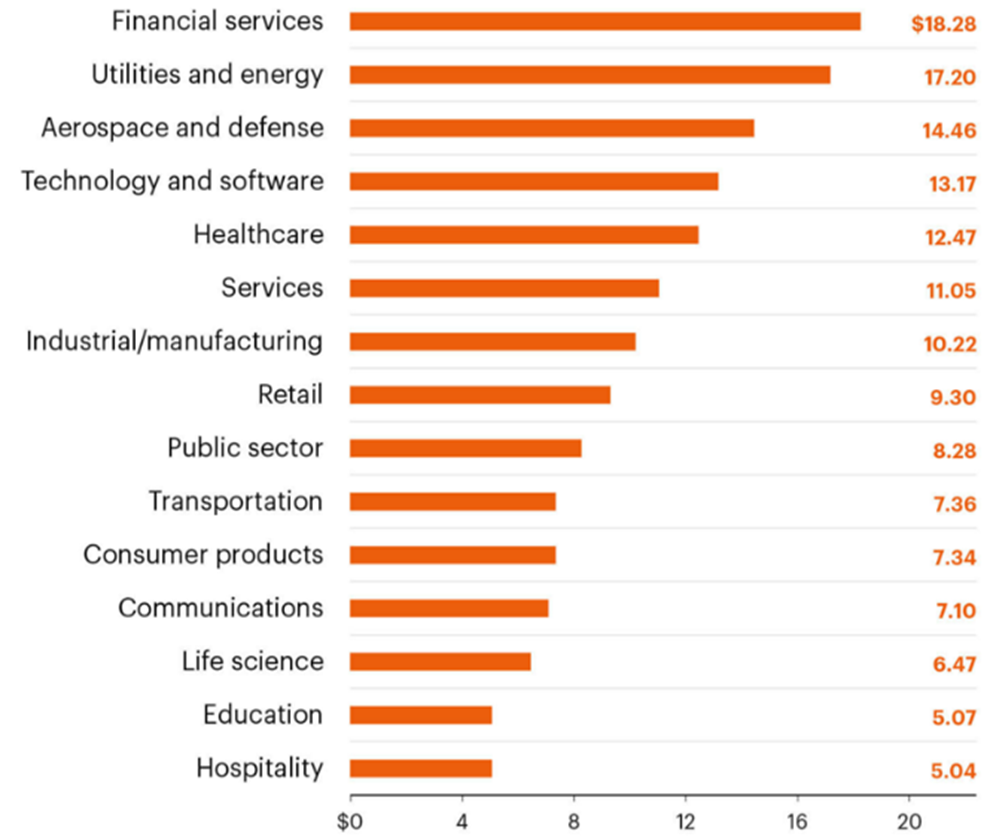

According to Accenture’s Cost of Cybercrime study, financial services incurred the highest cybercrime costs among all industries studied in 2017. The cost of cybercrime to the industry globally reached close to USD 20 million, up by 9.6% from 2016 (Bissel, LaSalle and Dal Cin 2017).

The adoption of FinTech should thus go hand in hand with the adoption of digital security to safeguard the handling of sensitive data and mitigate the threat of cybercrime. As a result, it is not surprising that as financial services firms embrace digitisation through FinTech, they are also increasing expenditure to combat cybercrime.

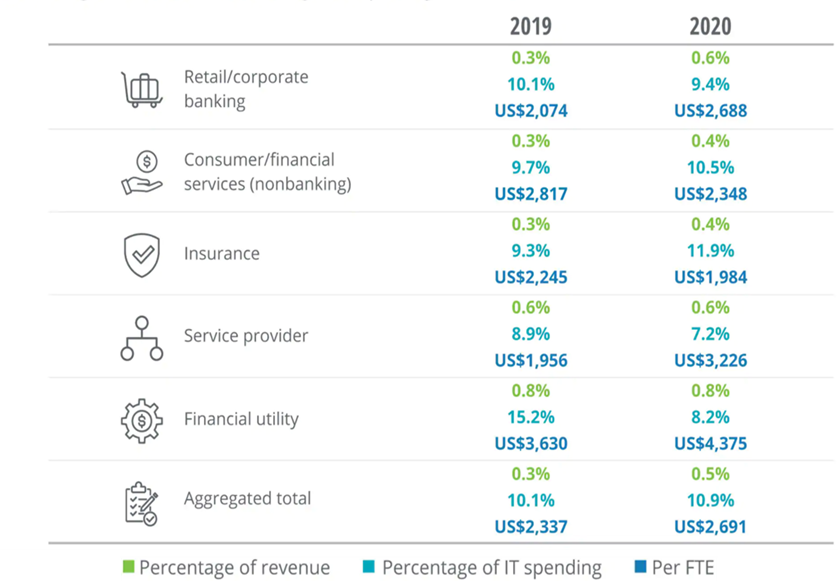

A recent survey by Deloitte on financial institutions’ IT expenditure found that firms surveyed spent about 10.9% of their IT budget on cybersecurity on average, up from 10.1% a year earlier. This equalled about 0.48% of company revenue on average, again up from 0.34%. Within the financial services industry, most of the revenue spent on cyber security was by financial utility firms such as clearinghouses, exchanges and payment processes, followed by firms providing retail and corporate banking services (Bissel, LaSalle and Dal Cin 2017).

As financial technology becomes widespread, FinTech firms are likely to see a surge in future earnings. Digital security firms are also likely to grow hand in hand, as consumers and FinTech firms seek to mitigate the threat of cybercrime.

Crea8 has put together an investment strategy to take advantage of this. The “Global FinTech and Digital Security” investment strategy lets you ride on this trend by investing in incumbent financial services firms that are adopting FinTech within their existing services, new entrants within the financial services industry that are pushing their FinTech services and leading digital security firms.

Through Crea8’s Factor Based Investing Service, you get the opportunity to invest in this trend.

Bull, Tom, Sharon Chen, and Doina Chiselita. 2019. “EY Global Fintech Adoption Index 2019”. Ey.Com. https://www.ey.com/en_gl/ey-global-fintech-adoption-index.

Bissel, Kelly, Ryan LaSalle, and Paolo Dal Cin. 2019. “2019 Cost Of Cybercrime Study | 9Th Annual | Accenture”. Accenture.Com. https://www.accenture.com/us-en/insights/security/cost-cybercrime-study.