FinTech companies are changing the way that people access financial services by providing them online for cheaper. As a result, incumbent financial services firms are forced to adapt as well. Financial firms that embrace the FinTech revolution are the ones likely to thrive.

FinTech, a portmanteau of finance and technology, represents the collision of two worlds—and the evolution of the use of technology in financial services. Financial services and technology are locked in a firm embrace, and with this union comes both disruption and synergies.

FinTech start-ups have mushroomed to provide retail consumers with almost all the services that a traditional financial institution. Due to their digital business models and lean operations, FinTech services often provide these services more conveniently and at a cheaper price.

FinTech firms are able to offer cheaper and more efficient financial services than traditional financial institutions. As a result, consumers like what they can offer.

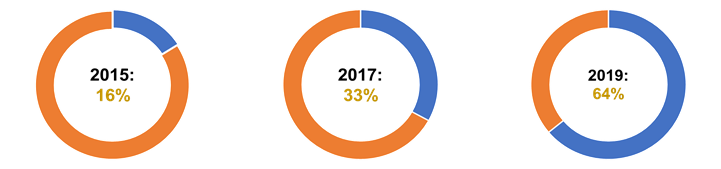

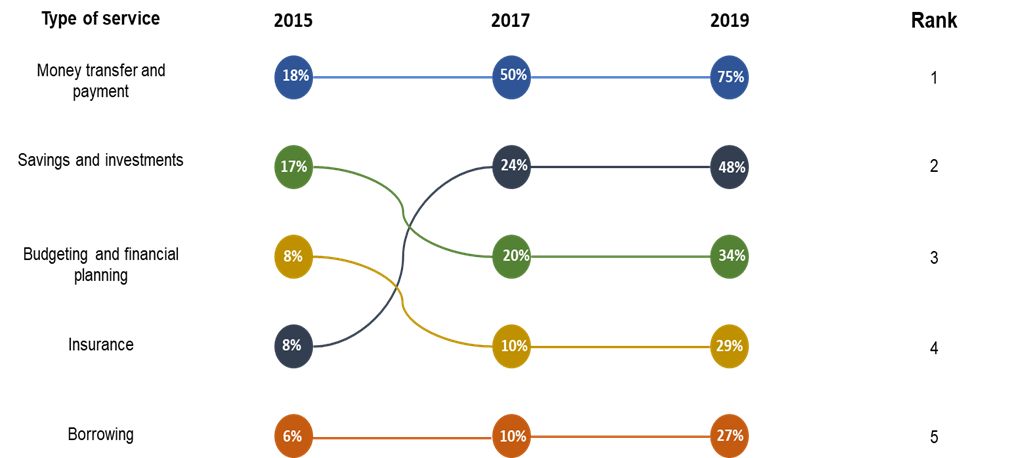

EY’s annual Fintech adoption survey asked consumers about their use of 19 FinTech services across five categories (money transfer and payments, budgeting and financial planning, savings and investments, borrowing, and insurance). A FinTech adopter was defined as someone who has used two or more of these services. Based on the EY FinTech Adoption Index, adoption of FinTech services has moved steadily upward, from 16% in 2015, to 33% in 2017, to 64% in 2019 (Bull, Chen and Chiselita 2019).

Within the services offered by FinTech firms, the most commonly used category is money transfer and payments, with 75% of consumers using at least one service in this category. In China, where money transfer and payment apps are pervasive, the adoption rate is 95% (Bull, Chen and Chiselita 2019).

The most used services in money transfer and payments category are peer-to-peer payments, non-bank money transfers, and in-store mobile payments due to the ease of setting up an account. Insurance shows strong adoption as well, with nearly half the consumers globally using a premium comparison site, feeding information into an insurance-linked smart device, or buying products such as peer-to-peer insurance (Bull, Chen and Chiselita 2019).

Digital innovation is disrupting and reshaping financial services at a rapid pace, and incumbents and challengers alike need to be attuned to the evolving expectations of their customers.

Challengers have built themselves using a design-first approach and agile work processes. By keeping a technology-forward mindset, they can offer FinTech services that are at once personalized, accessible, transparent, frictionless and cost-effective, characteristics that are highly appealing to consumers.

Of these characteristics, cheaper fees tend to be the most appealing to consumers. In 2017, 13% of consumers surveyed by EY said attractive fees were why they chose to use FinTech services. This increased to 27% in 2019 (Bull, Chen and Chiselita 2019).

As financial technology becomes widespread, FinTech firms are likely to see a surge in future earnings. Digital security firms are also likely to grow hand in hand, as consumers and FinTech firms seek to mitigate the threat of cybercrime.

Crea8 has put together an investment strategy to take advantage of this. The “Global FinTech and Digital Security” investment strategy lets you ride on this trend by investing in incumbent financial services firms that are adopting FinTech within their existing services, new entrants within the financial services industry that are pushing their FinTech services and leading digital security firms.

Through Crea8’s Factor Based Investing Service, you get the opportunity to invest in this trend.

Bull, Tom, Sharon Chen, and Doina Chiselita. 2019. “EY Global Fintech Adoption Index 2019”. Ey.Com. https://www.ey.com/en_gl/ey-global-fintech-adoption-index.

Bissel, Kelly, Ryan LaSalle, and Paolo Dal Cin. 2019. “2019 Cost Of Cybercrime Study | 9Th Annual | Accenture”. Accenture.Com. https://www.accenture.com/us-en/insights/security/cost-cybercrime-study.