Sustainable investing or Environmental, Social and Governance (ESG) investing is a strategy that centres on investing in companies that produce goods/services that have a positive environmental and social impact.

The strategy involves incorporating ESG factors into investment decision-making, thus incentivising better practices by companies.

ESG investing is an important strategy worth adopting. Here are 8 reasons:

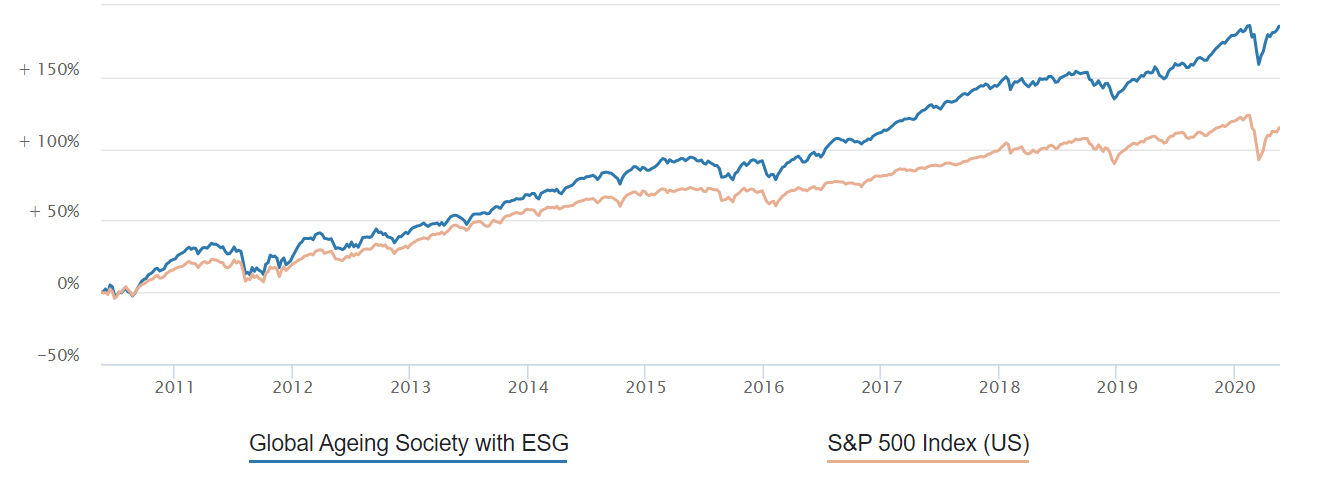

Top ESG-ranked companies recorded better performance than the average S&P 500 company.

New investments in ESG funds could total an estimated USD 20 trillion in the next two decades..

80% of all HNW investors say they expect companies to not only make a profit but also take responsibility for their impact on the environment and society.

53% percent of all HNW investors say a company’s ESG trade record is an important consideration in their decision about whether to invest in it or not. Those most likely to consider this important are millennials (87%), Gen X (65%) and women (64%).Source: 2018 US Trust Wealth and Worth Survey

There are newer ways to assess a company’s worth:

Intangible assets as percentage of total S&P 500 book value.

FY 1998: <30%

FY 2018: 68%An increasing amount of firm value can be attributed to “intangible assets” like brand reputation.

Royal Dutch Shell (an oil company) was toppled by AstraZeneca (a pharmaceutical firm) as the UK’s most valuable company in April 2020.

Source: Factset

The bottom-line to why employees are important.

41% of employers that were rated as “best places to work” outperformed those that were rated as “worst place to work”.

Millennials account for the largest proportion of the global workforce and are also conscious about their firms’ ESG compliance.

Firms that embrace ESG principles would have happier employees and lower staff turnover, which in turn would contribute to the success of the firm.

Ratings by job search firm Glassdoor

Investors could have avoided investing in up to 90% of S&P 500 companies that went bankrupt between 2005 – 2015 by screening out firms with below average environmental and social rankings from the prior 5 years.

Source: Refinitiv, Factset

Corporate bond issuers with positive ESG trends outperformed those with negative ESG trends.

ESG controversies hurt firms’ finances and investors’ confidence.

Volkswagen was fined USD 2.8 billion for “rigging diesel-powered vehicles to cheat on government emissions tests” (April 2017).

BP was fined USD 18.7 billion for the Deepwater Horizon oil spill (July 2015).Nearly 70 % of Hong Kong business leaders acknowledge that ESG is essential or good for business.

Source: “ESG: A view from the top” (2018) survey by KPMG, CLP and HKICS

To assess the profitability of ESG investing and how we integrate ESG investing seamlessly, check out our white paper “The Profitability of Sustainable Investing: A Structured and Systematic Approach for Optimal Portfolios”.