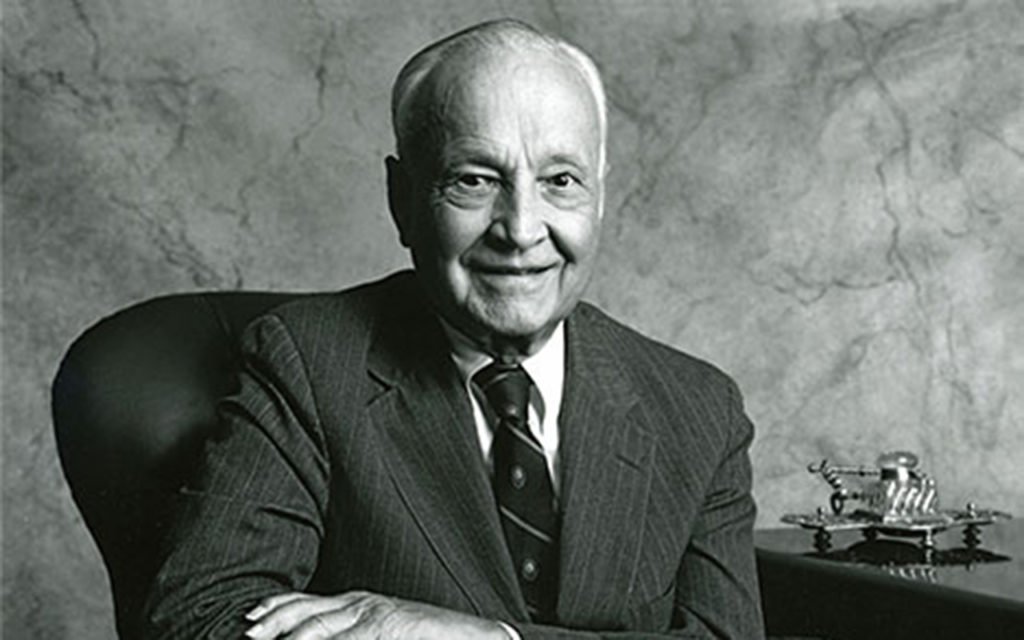

– Baron Rothschild

Contrarian investing, as the name suggests, means to go against the crowd and to be sceptical of the general market sentiment. Contrarian investors purchase and sell shares against the prevailing market sentiment.

Contrarian investors usually invest in depressed cyclical stocks with low or even negative earnings with the expectation that these stocks will rebound once the company’s earnings have turned around, resulting in substantial price appreciation.

Most investors tend to overweight recent trends and follow the crowd with their investment decisions. This tends to cause an overreaction to the prevailing trend. We have documented this in our 2003 published journal.

When this happens, more often than not, a company’s stock will appear cheap compared to historical levels or the stock of other companies with similar business models. A contrarian investor, noting this discount, buys the share and profits as the share price appreciates back to historical levels.

Some of the most famous investors globally swear by contrarian investing. Many professional investors employ this strategy.

Here are some of the more famous contrarian investors and their stories.

In Factor based thematic investing, Crea8 empowers you to be a contrarian investor in multiple ways:

You can create an unfashionable theme by limiting your investment universe to certain sectors and countries. This exposes you to the stocks most affected during that time.

There are many ways to construct contrarian portfolios: book‐to‐market, cash flow‐to‐price, earnings‐to‐price, past returns and other sophisticated valuation models.

Contrarian investors are most interested in undervalued investments. From your unfashionable theme, you can tilt your investment style to adopt our off-the-shelf ‘Value’ tilt or create your own flavour.

Crea8 analyses social media posts and news for sentiment. From there you can extract the required stocks that fit the extreme negative sentiment.

Crea8 can help you pick out today’s unloved stocks that could blossom into tomorrow’s next big investment. Check out our Factor based thematic investing service to see how you can do this.

For further insight into our investment methodology including our Factor based investing methodology, check out our white papers.